"The February Air Pocket": Buybacks Are Back But No Central Banks To Hold Traders' Hands

There will be two key themes for investors seeking to shake off the abysmal "as goes January" blues:

There will be two key themes for investors seeking to shake off the abysmal "as goes January" blues:

Amid denied rumors of production cuts (and Goldman's dismissal), crude oil prices have jumped "August 2015 Andy Hall squeeze style" to 3-week highs. This 'change' in trend has hedge funds calling the bottom once again adding to bullish oil bets at the fastest pace since 2010 in the last week. However, most ironically, it appears the weak longs are being squeezed today as WTI crashes 6%.

Still, it seems many are looking for a short-squeeze initiated bottom here... (as Bloomberg reports)

Back in 2012 and then again in 2013, after repeatedly observing just how broken markets have become as a result of central bank intervention, a topic that back then was still taboo and is now wholeheartedly accepted even by the Davos billionaires (whose mood the WSJ summarized as "irritated, bordering on affronted, with what they say has been central-bank intervention that has gone on too long") we presented what may have been the "best alpha opportunity around" and how to outperform the "market" in a world in which not only fundamentals no longer matter, but in which hedge fund he

Whether front-running or fear-based (or both), the actions of BoJ's Kuroda last week have driven global bond yields into freefall with JPM's global index at 9-month lows and BofA's at 12-month lows. Overnight saw short-end JGBs push below the BoJ's -10bps threshold and 10Y rates push towards NIRP to record lows. German bonds extending their epic voyage into fantasy and hit new record lows across the curve with 5Y at -32bps.

Bond yields across the globe are collapsing...

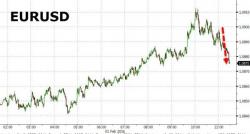

When Draghi speaks (or releases his statement), the algos obey.. and sell EURUSD. No new news at all - just a repeat of the same statements that "QE is deemed effective' (by whom we ask), and a recalibration is in order (as the situation has changed since December). His biggest problem from what we can tell is the fact that the banking industry's collapse augurs very badly for industrial production and an economic recession across Europe.

The headlines from Draghi's prepared remarks...