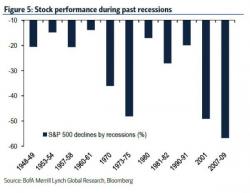

Who Is Right: Stocks Point To A Half-Recession; Oil Screams A Global Depression

The U.S. may not be in an official technical recession yet (and it won't be until the NBER retroactively opines at some point in the next few years) but what about a half-recession? After all, nobody debates any more that the U.S. manufacturing sector is now contracting and it is only the services sector which is, at best, still growing (just ignore the last few Service ISM and PMI reports confirming that the manufacturing recession is rapidly spilling over).