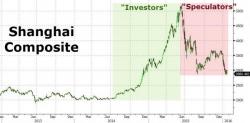

The Birth Of The PetroYuan (In 2 Pictures)

Give me that!!

It belongs to the Chinese now!

h/t @FedPorn

As we previously detailed, two topics we’ve deemed critically important to a thorough understanding of both global finance and the shifting geopolitical landscape are the death of the petrodollar and the idea of yuan hegemony.

In November 2014, in “How The Petrodollar Quietly Died And No One Noticed,” we said the following about the slow motion demise of the system that has served to perpetuate decades of dollar dominance: