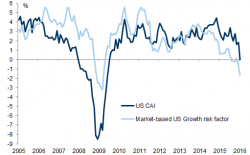

Goldman Sends Out Chart Showing U.S. In Recession, Promptly Retracts It

Earlier today, Goldman's global macro strategist team led by Noah Weisberger released a report titled "Markets do not "Take it Easy" to start the year", which had one very disturbing slide, i.e., "Exhibit 8." - disturbing, because it showed that according to Goldman's Current Activity Indicator, the US was effectively in recession; certainly disturbing enough for us to immediately tweet it with just one comment: "Oops":

Oops from GS pic.twitter.com/jz0LCculCQ