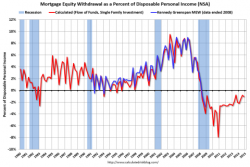

Why Dip Buyers Will Get Clobbered: The US Economy Isn't Doing "Just Fine"

Submitted by David Stockman via Contra Corner blog,

As of June 2008 no Wall Street banking house was predicting a recession, yet by then the Great Recession - the worst economic downturn since the 1930s - was already six months old, as per the NBER’s subsequent official reckoning.