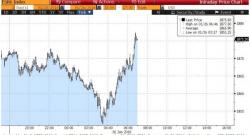

As we noted in the overnight wrap, after sliding by 1%, and hitting an overnight low of 1,850, just as Europe opened US equity futures staged a furious rebound jumping nearly 30 point in under three hours for reasons largely unknown: surely it wasn't hope that the Saudis would do any aggressive oil production cutting especially when considering what the CEO of Aramco Amin Nasser said moments ago, namely that the global economy is not encouraging for demand growth, adding that "The current price is definitely a supply-demand issue" hoping that "With low oil prices, demand hopefully will also