Big Bad China

Submitted by $hane Obata via Tha Business blog,

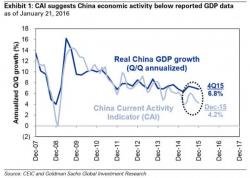

It seems like every day we are inundated with news out of China. Investors are already concerned. The offshore renminbi (CNH) is more international than the onshore one (CNY), which is tightly managed by the government. As such, the rising spread (CNH-CNY) between the two may be indicative of mounting skepticism about China’s economy and its markets. Likewise, capital is fleeing the country as hot money flows have accelerated:

source: @vikramreuters