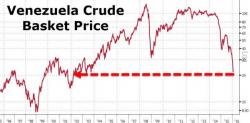

Maduro "Wake Up" Call For OPEC As Venezuela Crude Crashes To 13 Year Lows

Venezuela's crude oil basket price collapsed to as low as $20.20 yesterday, according to the socialist utopia's President Maduro. Having already "passed the point of no return," Maduro rages that OPEC producers appear to be "finally waking up" to what they have unleashed noting that, according to him, Russia's Putin has agreed to "work on oil price issues."

More jawboning and hope...