We Know How This Ends - Part 2

Submitted by Jeffrey Snider via Alhambra Investment Partners,

Part 1 is HERE.

Submitted by Jeffrey Snider via Alhambra Investment Partners,

Part 1 is HERE.

Earlier today, the Bank of Canada surprised some market participants by failing to cut rates.

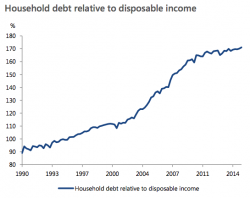

True, the loonie was plunging and another rate cut might very well have accelerated the decline, further eroding the purchasing power of Canadians who are already struggling to keep up with the inexorable rise in food prices, but there are other, more pressing concerns.

Remember when Bitcoin and its digital currency cohorts were slammed by authorities and written off by the elite as worthless? Well now, as the war on cash escalates, officials from The IMF to China are seeing the opportunity to control the world's money through virtual (cash-less) currencies.

Submitted by Gail Tverberg via Our Finite World blog,

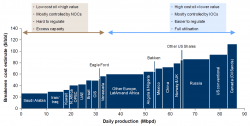

A person often reads that low oil prices–for example, $30 per barrel oil prices–will stimulate the economy, and the economy will soon bounce back. What is wrong with this story? A lot of things, as I see it:

1. Oil producers can’t really produce oil for $30 per barrel.

With December's seasonal shenanigans out of the way, and following 2 record-breaking weekly builds in gasoline stocks, with expectations of a 2.3mm barrel build API reported a large 4.6mm inventory build (double expectations) . Cushing inventories built 63k, rising for the 12th week in a row. Gasoline stocks rose once again (+4.7mm) and Distillates also (+1.5mm).

December is over...

Following crude's v-shaped recovery today, API's huge build sent WTI back lower...

Charts: Bloomberg