![]()

See this visualization first on the Voronoi app.

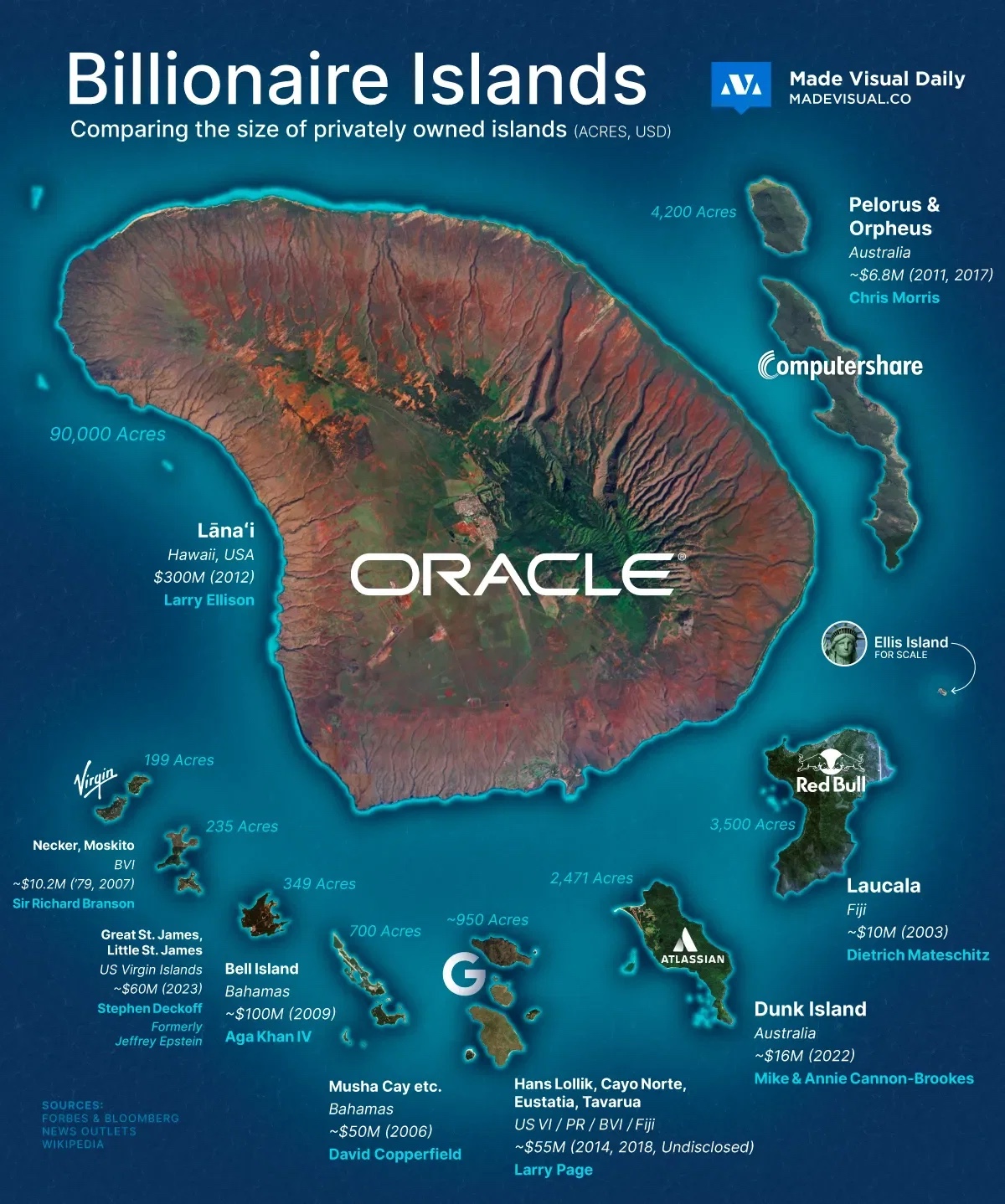

Inside the World of Billionaire Islands

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Tech titans own the biggest slices of paradise—Larry Ellison’s purchase of Lānaʻi (90,000 acres) outscales the next-largest island more than 25-to-1.

- Price per acre varies wildly: Bell Island in the Bahamas cost approximately $286,500 per acre ($100 million for 349 acres), while Ellison paid roughly $3,300 per acre for Lānaʻi ($300 million for 90,000 acres).

- Even modestly-sized islands command premium prices when located near luxury tourism hubs or equipped with existing infrastructure.

From Coastal Australia to the turquoise waters of Fiji, billionaires have snapped up private islands as the ultimate status symbols.

The graphic above, by Made Visual Daily, compares the acreage and sticker prices of some of the best-known billionaire islands, revealing just how uneven the market is.

| Billionaire owner | Island / cluster | Country / Region | Combined size (acres) | Reported cost | Year(s) |

|---|---|---|---|---|---|

| Larry Ellison (Oracle) | Lānaʻi (98 % of island) | Hawaii, USA | ≈ 90,000 | $300M | 2012 |

| Chris Morris (Computershare) | Orpheus Is. + Pelorus Is. | QLD, Australia | ≈ 4,200 | Orpheus $6.25M Pelorus undisclosed |

2011 & 2017 |

| Estate of Dietrich Mateschitz (Red Bull) | Laucala Island | Fiji | 3,500 | $10M | 2003 |

| Mike & Annie Cannon‑Brookes (Atlassian) | Dunk Island | QLD, Australia | ≈ 2,471 | $16M | 2022 |

| Larry Page (Google) | Hans Lollik pair + Cayo Norte + Eustatia + Tavarua | US VI / PR / BVI / Fiji | ≈ 969 | Hans Lollik $23M + Cayo Norte $32M ≥ $55M (Eustatia & Tavarua undisclosed) | 2014‑2020 |

| David Copperfield | “Islands of Copperfield Bay” – Musha Cay + 10 satellites | Bahamas | ≈ 700 | $50M | 2006 |

| Aga Khan IV | Bell Island | Bahamas | 349 | $100M | 2009 |

| Stephen Deckoff | Great St. James + Little St. James | US Virgin Is. | ≈ 235 | $60M (for both) | 2023 |

| Sir Richard Branson | Necker Is. + Moskito Is. | BVI | ≈ 199 | Necker $180K + Moskito $10.2M | 1979 & 2007 |

Why Size Isn’t Everything

Island valuations depend on far more than acreage alone. Proximity to major airports, protected harbors, and existing resort infrastructure can drive prices exponentially higher. Bell Island’s $100 million price tag for just 349 acres reflects its prime location in the Exumas archipelago in The Bahamas, a renowned luxury-yacht destination with established high-end amenities.

The location premium becomes clear when comparing cost per acre: Bell Island costs roughly 87 times more per acre than Lānaʻi, demonstrating that exclusivity and accessibility often outweigh sheer size in determining value.

The Tech Billionaire Land-Grab

Technology entrepreneurs have emerged as dominant players in the private island market. There are a few reasons behind this trend:

- Unprecedented wealth accumulation: The tech boom has created liquidity that enables nine-figure recreational purchases previously reserved for oil barons and industrial magnates.

- Remote work capabilities: Modern satellite communications and digital infrastructure allow tech leaders to maintain business operations from virtually anywhere, making isolated islands viable as working retreats.

- Privacy and security concerns: High-profile tech executives increasingly seek refuges from public scrutiny and potential security threats, with private islands offering unparalleled isolation and control.

Cost per Acre: The Luxury Premium

The private island market reveals stark disparities in pricing based on location and amenities. Ellison’s $300 million acquisition of 98% of Lānaʻi in 2012 included not just land but two Four Seasons resorts, championship golf courses, and existing infrastructure serving the island’s 3,000 residents.

In contrast, smaller Caribbean properties like the Aga Khan’s Bell Island purchase command premium prices due to their proximity to established luxury tourism circuits and superior accessibility via private aircraft and superyachts.

This market segmentation suggests that beyond a certain size threshold, factors like location, climate, and existing development become the primary value drivers rather than raw acreage.

Learn More on the Voronoi App ![]()

What are the world’s most populated islands? Find out with this post on the Voronoi App.