A Simple Warning

Via KesslerCompanies.com,

Via KesslerCompanies.com,

Economic expert, Pepe Escobar, has warned that selected Persian Gulf traders, including Westerners working in the region, have confirmed that Saudi Arabia is secretly unloading $1 trillion in securities in a bid to crash the global economic markets. According to insiders, a further $12 trillion may be dumped, causing world markets to spiral into a depression, the likes of which we have never seen before.

Despite the collapse in Chinese stocks, Bloomberg reports annual sales of Chinese equity-linked structured notes across AsiaPac rose to a record (prompting Korea's financial regulator to warn investors in August that their holdings had become too concentrated in notes tied to the China H-Shares index). When banks sell the structured products to investors, they take on an exposure that's similar to purchasing a put option on the index...

Back in November, JPM prophetically warned that "The long period of indiscriminately buying any dip might be coming to an end." Today it's official, and from the same JPM, in its closing day trading note we read that "dip buying is officially dead and stocks (esp. US ones) are no longer impressed by promises of central bank largess."

From Adam Crisafulli's LookBack at the Market

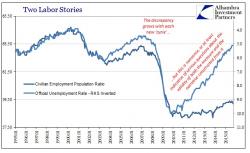

Submitted by Jeffrey Snider via Alhambra Investment Partners,