Last Bubble Standing

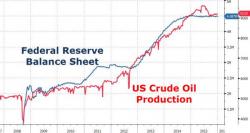

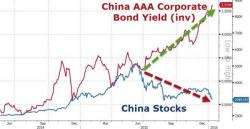

EM debt bubble... emaciated, FX Carry... crucified, Crude...crushed, High yield bonds... burst, Chinese equities... blown, Trannies... trounced, Small Caps... slammed, Biotechs... busted, and FANGs finally FUBAR! But there is one big (very big) bubble left in the world that no one is talking about, and a rather large liquidity-busting pin beckons...