What Keeps Bank Of America's Junk Bond Analyst Up At Night

From BofA's Michael Contopoulos

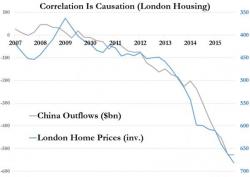

You don’t need a recession

From BofA's Michael Contopoulos

You don’t need a recession

If ever there was any doubts about the narrative of freedom-seeking China capital outflows driving the irrationally exuberant prices of homes in some of the world's largest cities to record highs, the following two charts will extinguish them entirely.

Traders who may have napped through the earlier oil slide below $28 finally woke up just in time for the China open to find that while there was little excitement on the currency front following a Yuan fixing, which at 6.5578 was practially unchanged from yesterday's midpoint of 6.5596...

...the Shanghai composite - following yesterday's torrid, manipulated last hour surge - opened 0.5% lower, sliding back below the 3,000 level which was breached last week for the first time since last summer.

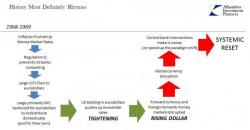

Submitted by Jeffrey Snider via Alhambra Investment Partners,

The Fed may have officially tapered QE at the end of 2014 but that doesn't mean it is done buying Treasuries: since the Fed never ended rolling over maturing paper, it means that it will remain indefinitely active in the open market. And while there were no sizable maturities from the Fed's various QEs to date (only $474 million in 2014 and $3.5 billion in 2015) that will change dramatically this year, when Brian Sack's team will have to purchase about $216 billion to replace matured TSYs.