Frontrunning: January 21

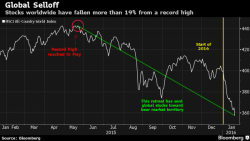

- Global Stocks Face Fresh Losses (WSJ)

- European stocks lick wounds after mauling, oil steady (Reuters)

- Hang Seng Index Sinks Below Net Assets for First Time Since 1998 (BBG)

- U.S. Hedge Funds Boast Lower Losses as Markets Tumble Further (NYT)

- Deutsche Bank Drops as Investment Bank Revenue Concerns Mount (BBG)

- Islamic State Uses Syria’s Biggest Dam as Refuge and Potential Weapon (WSJ)

- Goldman-run funds most popular with Republican candidates, disclosures show (Reuters)