Presenting The Central Banks' Munitions Arsenal (Or What's Left Of It)

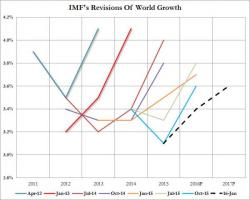

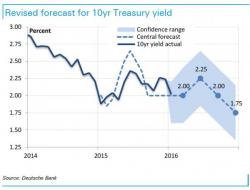

While most of new rounds of US QEs (2008, 2010, 2012), and Japan QE (2013) managed to depress volatility and boost asset pricing, late-cycle European QE failed to domesticate markets for long. By Q2, markets were already toppish, and volatility able to erupt, in the face of Central Banks activism. In 2015, financial markets started rioting against monetary activism and market manipulation by global Central Banks.