In "Very Unusual" Move, Avenue Capital's Junk Bond Fund Stops Reporting Asset Levels

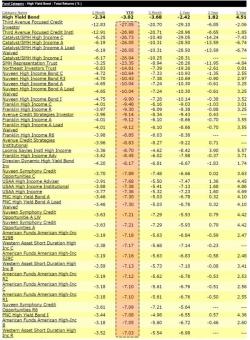

A month after we first noted the major redemptions at Avenue Capital Group's credit fund (note this is a different fund from Third Avenue), and just one trading day after CEO Marc Lasry strolled arrogantly on to CNBC and told the public that "I don't think it's a time to panic, I think it's actually a time where you've got opportunities out there," Morningstar reports the Avenue Credit Strategies Fund has failed to report asset levels since about mid-December.

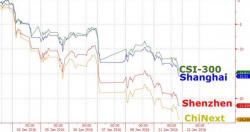

As we noted first in mid-December...