JPM Explains How Crude Carnage Creates $75 Billion SWF "Contagion" For Equities

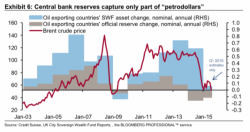

Back in August, we explained why the great petrodollar unwind could be $2.5 trillion larger than anyone thinks.

China’s effort to “control” the glidepath for the yuan devaluation led to a dramatic decline of Beijing’s FX reserves and pushed reserve liquidation to the front of the market’s collective consciousness.