Art Cashin: This Is "What You Get Before You Slip Into A Crisis"

Via Christoph Gisiger of Finanz Und Wirtschaft,

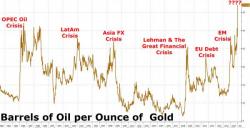

Wall Street veteran Art Cashin warns that bankruptcies in the US oil industry could cause severe stress in the financial system. He believes the rate hike of the Federal Reserve was a mistake.