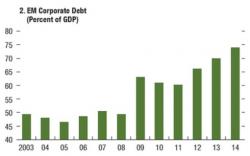

The Bursting of the Bond Bubble Has Begun

The bursting of the bond bubble has begun.

As I’ve outlined previously the primary concern for Central Banks is the bond bubble. CNBC and other financial media focus on stocks because the asset class is more volatile and so makes for better content, but the foundation of the financial system is bonds. And bonds are THE focus for Central Banks.