Despite TurmOIL Stocks Stage Furious Last-Hour Comeback

The Fed's apparent new communication policy (as the rest of the world's markets and policy-makers try to force its hand)...

The Fed's apparent new communication policy (as the rest of the world's markets and policy-makers try to force its hand)...

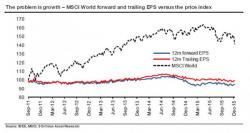

Earlier today, when Bank of America said that "panic is building" in the market and asked, rhetorically, "how bad could it get", it listed what it thought are the five core pillars in the bailed out bank's wall of worry:

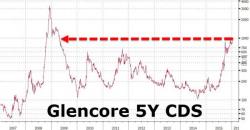

While the biggest bankruptcy story of the day is this morning's chapter 11 filing by Arch Coal, one which would trim $4.5 billion in debt from its balance sheet while handing over the bulk of the post-reorg company to its first-lien holders as part of the proposed debt-for-equity exchange, the reality is that the Arch default was widely anticipated by the market.

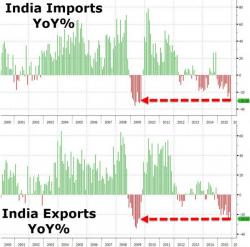

In late September, India “surprised” 51 out of 52 economists by cutting rates a larger than expected 50 bps.

Despite RBI Governor Raghuram Rajan’s penchant for catching markets off guard and despite the fact that exports had fallen for eight consecutive months, economists still failed to predict that anything more than 25 bps was in the cards.

Submitted by Michael Snyder via The Economic Collapse blog,