Norway Pushes Panic Button: "We're In A Crisis Now, We Can't Deny That"

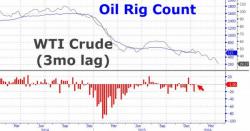

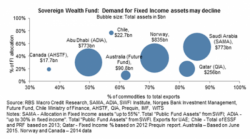

We’ve spent quite a bit of time documenting Norway’s precarious balancing act in the face of slumping crude prices.

On the one hand, falling crude puts pressure on the krone which essentially allows the Norges Bank to compete in the regional currency wars without resorting to the same type of deeply negative rates as the ECB, the Riksbank, the Nationalbank, and the SNB. In short, a falling krone preserves export competitiveness in a world gone Keynesian crazy.