Here is How You Fix the Oil Market

By EconMatters

The Mining Industry Approach

By EconMatters

The Mining Industry Approach

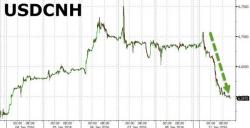

While some central banks prefer to stealthily 'manage' their markets, a bid here, a stick-save there, today's epic intervention, short-squeeze, carry-trade-carnage in Offshore Yuan is the most visible hand yet in the new normal world of central planning. USDCNH is now down over 850 pips on the day - a record 1.25% strengthening in the offshore Yuan...

CNH is now 15 handles stronger from the "halt" spike lows last week...

This is the biggest single-day drop in USDCNH (strengthening in Offshore Yuan) since records began...

Submitted by Nick Cunningham via OilPrice.com,

Saudi Arabia’s deputy crown prince Muhammad bin Salman made headlines this week when he said that the kingdom was considering an IPO of Saudi Aramco, the nation’s state-owned oil company.

Submitted by Tommy Behnke via The Mises Institute,

On Tuesday, it was announced that over seventeen million new vehicles were sold in 2015, the highest it’s ever been in United States history.

While the media claims that this record has been reached because of drastic improvements to the US economy, they are once again failing to account for the central factor: credit expansion.

Some very worrisome charts for investors to consider.

Stocks just took out their neckline.

Unprofitable Wall Street darling, Tesla (TSLA), which requires mountains of new debt at low interest rates to survive, has taken out its trendline.

Europe’s “canary in the coalmine” just kicked it. Spanish bank Santander (SAN) is sitting atop a mountain of garbage debt from a housing bubble that DWARFED the US's. The country might even break into multiple fragments!