Comcast, We Have a Problem

By EconMatters

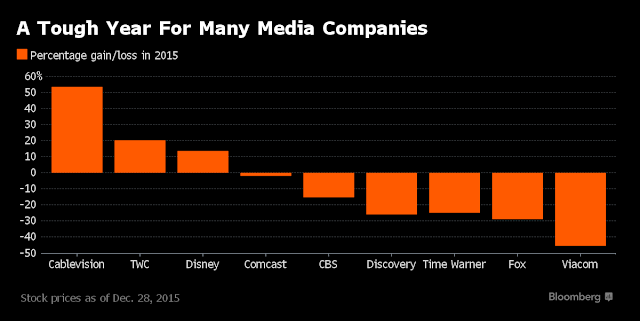

The bigger news in the cable industry is that the U.S. Justice Department's threat to block the purchase/merger of Comcast (NASDAQ: CMCSA) and Time Warner Cable (NYSE: TWC) did result in Comcast withdrawing its stock-swap proposal to acquire TWC in April, 2015. However, TWC soon afterwards entered into an agreement to be acquired by Charter Communications in May.