Oil Bankruptcies Hit Highest Level Since Crisis And There's "More To Come", Fed Warns

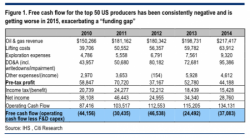

“Two things become clear in an analysis of the financial health of US hydrocarbon production: 1) the sector is not at all homogenous, exhibiting a range of financial health; 2) some of the sector indeed looks exposed to distress [and] lifelines for distressed producers could include public equity markets, asset sales, private equity, or consolidation. If all else fails, Chapter 11 may be necessary.” That’s Citi’s assessment of America’s “shale revolution”, which the Saudis have been desperately trying to crush for more than a year now.