During the Next Crisis, Central Banking Itself Will Fail

For six years, the world has operated under a complete delusion that Central Banks somehow fixed the 2008 Crisis.

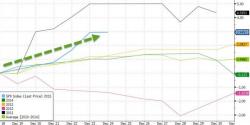

All of the arguments claiming this defied common sense. A 5th grader would tell you that you cannot solve a debt problem by issuing more debt. If the below chart was a problem BEFORE 2008… there is no way that things are better now. After all, we’ve just added another $10 trillion in debt to the US system.