The Keynesian Recovery Meme Is About To Get Mugged, Part 2

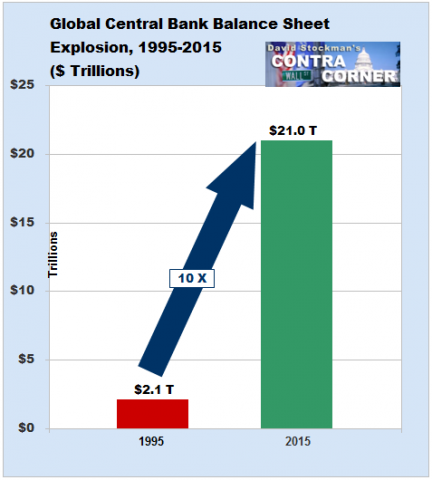

Submitted by David Stockman via Contra Corner,

Our point yesterday was that the Fed and its Wall Street fellow travelers are about to get mugged by the oncoming battering rams of global deflation and domestic recession.