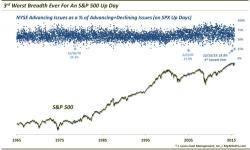

Horrific Breadth For A "Rally"

Via Dana Lyons' Tumblr,

Despite yesterday’s rally in the major indices, the underlying breadth statistics were historically weak.

Via Dana Lyons' Tumblr,

Despite yesterday’s rally in the major indices, the underlying breadth statistics were historically weak.

For the third month in a row US Industrial Production dropped MoM, crashing 0.6% in November (against expectations of a mere 0.2% drop). This is the 9th month of 2015 with no MoM increase in industrial production and is the biggest MoM drop since March 2012. However, for the first time since Dec 2009, Industrial Production fell YoY (down 1.2%) signalling America is deep in recession. The excuse blame is "unusually warm weather" which sent the utilities index down 4.3% as demand for heating tumbled.

Housing Starts rose 10.5% in November (after plunging 12% in October) as it appears weather-weakened construction caught back up with single-family starts recovering from the plunge in October. The South saw the biggest spike (up 21%) and Northeast fell 8.5%. Building Permits rose 11% MoM (after a 5.1% last month) as multi-family spiked from 446 to 566 (driven by a 22% spike in The Midwest and The West). This is the biggest MoM gain since Dec 2010.

Permits spiked most in 5 years, Starts surged...

Is this supposed to happen on the day the Fed's rate hike is "boosting confidence in the economy" and telegraphs more gains for the dollar?

Or perhaps these are just early hints that the world's most crowded trade, being long the USD, is starting to crack?