The End Of The Bubble Finance Era

Submitted by David Stockman via The Daily Reckoning blog,

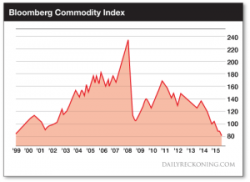

We are nearing a crucial inflection point in the worldwide bubble finance cycle that has been underway for more than two decades. To wit, the world’s central banks have finally run out of dry powder. They will be unable to stop the credit implosion which must inexorably follow the false boom.

We will get to the Fed’s upcoming once in a lifetime shift to raising rates below, but first it is crucial to sketch the global macroeconomic context.