Bitcoin Blasts Through $15,000 - "It's A Consensus Hallucination"

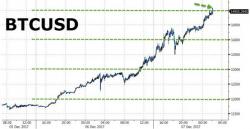

In the last 36 hours, Bitcoin has blasted through $12,000, $13,000, $14,000, and now $15,000 levels in an unprecedented 28% surge...

For those keeping track, this is how long it has taken the cryptocurrency to cross the key psychological levels: