A reader emailed us, to ask a few pointed questions.

Paraphrasing, they are:

- Who cares if dollars are calculated in gold or gold is calculated in dollars? People care only if their purchasing power has grown.

- What is the basis good for? Is it just mathematical play for gold theorists? How does knowing the basis help your readers? Is it just a theoretical explanation of what has already happened?

- Prove that if someone has known the basis for the last four years, he has benefitted.

He also added:

“Most websites on gold I’ve seen I have no respect for. They are snake oil salesmen trying to sell gold. Yours is not. So in that sense you guys are honest.”

That number, again, is 1-800-GOT-GOLD!

Just kidding. Thank you, sir, for your kind words and now let’s address your questions.

First, we have a general response. It is good to know the truth, for its own sake, even if there is no immediate or obvious practical benefit. The world works a certain way and, speaking for ourselves, we want to know what that way is. As they say, knowledge is power. This is doubly so with gold, where there is so much misinformation, disinformation, and rubbish economics. Some of it is mainstream, such as quantity theory of money. Some of it is unique to the gold market, such as allegations of manipulation.

Perhaps this particular set of truths about the gold market is of interest only to gold theorists. We are gold theorists, so it is of interest to us. Gold theorists number among our readers, too. But we argue that this particular set of truths should be of interest to everyone.

The greatest danger of our era is the coming monetary collapse. It is the inevitable consequence of irredeemable currency, exponentially rising debt, and falling interest. Many know that gold is part of the solution, but how? Is it just something one buys, as a speculation, to sell when its price rises?

We believe that gold is much more than that. And we argue that the belief that one must speculate to increase purchasing power is an inevitable consequence of the Fed’s war on interest. Deprived of the ability to get a reasonable yield, people turn to speculation as a surrogate.

The economic effects of investing for yield are opposite to those of speculating for capital gains. In the former, you finance an increase in production and your return comes from some of that increase. In the latter, you give your capital to a previous speculator who is exiting, and your gain comes from the next speculator handing his capital to you. Speculation converts someone’s wealth into someone else’s income, to be spent. It is a process of eating the seed corn, as Keith discusses in his series on Yield Purchasing Power.

This is one reason why we insist that gold is money, and one must calculate the value of the dollar in gold terms (i.e. 24.3 milligrams) rather than the value of gold in dollars (i.e. $1,280). The lighthouse does not move higher and lower, the steel meter stick does not get longer and shorter, and gold does not go up and down. It’s the sinking boat in the storm, the rubber band, and the dollar which move.

Another is that only with this understanding can one grasp other phenomena. For example, the sputtering and slow withdrawal of the gold bid on the dollar. In all markets in all places and times, there is a principle that the bid can withdraw in times of stress or crisis. It is never the offer that withdraws, but the bid. For example, Keith often asks what if the US Geological Survey said there will soon be an earthquake in Los Angeles, 15 on the Richter Scale? There will be many offers to sell real estate in LA. But no bid, probably from Santiago, Chile to Vancouver British Columbia, and as far east as the Mississippi River.

If one thinks that the dollar is money, and gold is a commodity, how to explain backwardation? Is it the one exception, where the offer to sell something is withdrawn while the bid is robust? What is one to make of gold backwardation (when cobasis > 0)?

Only with a clear picture, i.e. that gold is money and the dollar is credit paper, can one see that gold backwardation is serious business. It is an early harbinger of the end of our monetary era. By this, we do not mean: there will be a recession, stock market correction, or inflation (rising consumer prices). When the capital of an enterprise has been siphoned off over a period of decades, and debt is racked up beyond all means or intent to repay, and finally the inevitable default on the bond occurs, the price of that bond can go to zero.

This is not a price of gold of infinity, but a price of the dollar of zero.

But, to paraphrase our old friend Aragorn, today is not that day! In the meantime, the dollar is strong. And it has been getting stronger since early September (when it was 23.1mg gold).

On to the practical reasons to follow the gold basis and Monetary Metals research. As our reader noted, we often show what happened. We see two benefits to this. One, if you know that a bunch of speculators jumped on a Fed announcement with leverage, you know not to pile in after the gold price has blipped up $20. You know it’s not likely a durable move. Two, you may even fade the move.

The Monetary Metals Supply and Demand Report is not a trading letter. At the core, it shows a picture of, well, supply and demand conditions in the gold and silver markets. Occasionally, we will note that a metal seems underpriced or alternatively, we may say caveat emptor. On our site, we publish graphs of our calculated premium or discount on gold and silver.

While we do not say “buy here” and “sell there”, we provide a unique data set and view, not available anywhere else, to help inform traders. The basis provides actionable trading information, even if we don’t spell it out, and we use it to trade our Gold Exponential Fund.

Can we prove that readers have benefited over the past 4 years? No, and yes. No, because we don’t call trades. So we cannot tabulate simple results. But yes, because we preserve everything we have written going back to the launch of our website in January 2013. Between public and premium (free, but requires an email address) Supply and Demand Reports, you can go back to see what we were saying when we said it. For example, in July 2016 the price of silver seemed to be on a tear. It went from around $14 at the beginning of the year, to over $20.

What did your favorite silver analyst say at the time? We said many things along the way, but let’s bracket the move.

At the start, on January 31, 2016, we titled our Report Possible Sign of Silver Turn. We said:

“It’s far too early to call a bottom in the silver price. However, the movement on Thu and Fri is the sort of action we should expect to see more of if silver is to return to a bull market. It will take more action like this before we change our position on the white metal, but it is worth reporting on what we see when we see it.”

At the end of the move, on July 3, 2016 we said that our calculated fundamental price was about $3 under the market price. We encourage readers to go through the archives. Our policy is to preserve the record of every article we published.

As we recall, at every price blip there were many analysts saying to buy before the metals shoot up to the moon. Perhaps we should be thankful for bitcoin, in that some of the most hyperbolic hyperventilators have moved to this exciting new speculative market.

If we were to do a standard business SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) for the gold brand name, we would have to say that the biggest weakness is the snake oil salesmen and the rubbish economics they push. They come out most especially when the price has blipped, when they know many people are likely to be excited and excitable.

We publish daily charts and a weekly Report to show an honest look at the market conditions. The next time someone tells you that demand for physical metal is off the charts, but they are selling paper gold by the billions, you have the data to know if it’s true.

To conclude, the monetary system is moving inexorably towards Armageddon. There is no single better indicator than the gold basis. Right now, the near contract basis is +0.83%. Armageddon is not imminent.

Today is not that day.

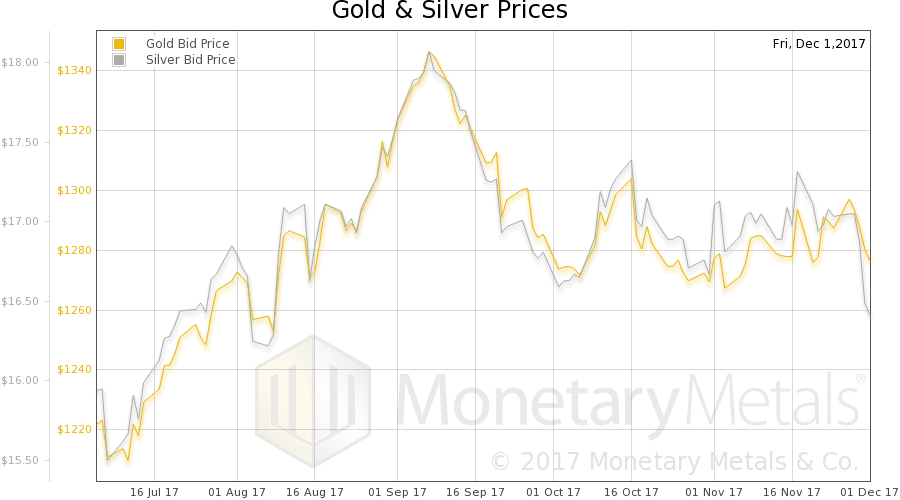

The prices of gold and silver dropped $7 and $0.61 respectively. This means, the gold-silver ratio jumped up, from 75.64 to 78.03. We have been calculating a fundamental value of the ratio above the market value from the end of July, though it dipped in November. This week, both the market and fundamental rose with a vengeance.

We will discuss the fundamentals and how they changed this week. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio.

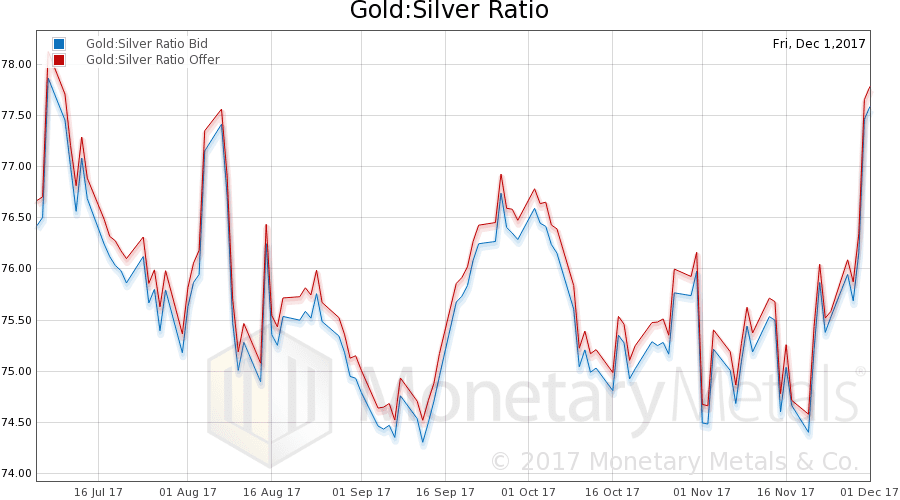

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose sharply.

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph showing gold basis and cobasis with the price of the dollar in gold terms.

The cobasis (our measure of scarcity) broke out, rising noticeably, as the price of gold fell slightly.

The Monetary Metals Gold Fundamental Price is up 5 bucks to $1,312, notwithstanding that the market price is down this week.

Now let’s look at silver.

In silver like in gold, we see the cobasis up sharply. However, unlike in gold, the price dropped quite a lot.

And so we have a good news / bad news scenario. The good news is that the Monetary Metals Silver Fundamental Price is now about 50 cents over the market price. The bad news is that it is down 32 cents.

If you trade the fundamental, this may be a good time to buy silver. Or if you are a contrarian. The price has been sold down a lot, to a level not seen since August. If you prefer to do technical analysis on the fundamentals (the fundamental price is not technical analysis in itself, notwithstanding some have claimed that), then you may see momentum developing to the downside and wish to wait for it to stabilize.

All we can say is that, if you back out the actions of the speculators, supply and demand of physical metal meet around $16.92. The market price closed on Friday at $16.41.

The fundamentals could weaken further. The market price could fall further without change in the fundamentals.

It is not the purpose of this letter to say what traders ought to do. We can say that, in our fund (which trades the gold-silver ratio) we are long silver for the first time since the summer.

© 2017 Monetary Metals