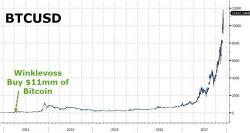

Crypto Surge Sparks Establishment Panic: Bans, Crackdowns, & Fatwas As Bitcoin "Undermines Governments, Destabilizes Economies"

The last few months have seen increasing notice being paid to Bitcoin (and the broader cryptocurrency space) by those that control the status quo.

At first it was simple 'negative'-speak - "you'd be a fool to buy Bitcoin"-esque comments spewed forth from the truly ignorant or intentionally-ignorant (this group included bank CEOs, asset managers, payments systems, and remittance services) but to no avail, those fools saw the value of their bitcoins surge... Like the Winklevoss twins...