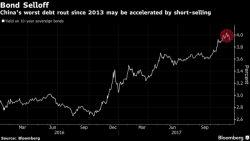

Short Sellers Are Aggravating China's Bond Rout - Regulators AWOL (For Now)

After the Party Congress finished in October and China’s centrally planned markets were released (somewhat) from the vice-like grip which had prevailed during the proceedings, we noted the comment from Huachuang Securities that China’s bond holders may be about to get hit by “daggers falling from the sky”, referring to deleveraging. They were right, to some extent, as first the government bonds, then corporate bonds sold off during November.