Why Deutsche Thinks 2017 "Was The Most Boring Year Ever"

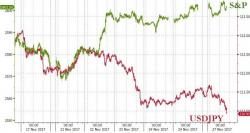

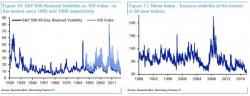

As part of the macro forecast in his just released 2018 Credit Outlook (more on that in a subsequent post), DB's Jim Reid first looks back at the almost concluded 2017 and muses that "whichever way you cut it, it’s likely that 2017 will go down as one of, if not the least, volatile year ever for the vast majority of asset classes. The recent sell-off in early/mid November has been a bit of a wake-up call but overall this remains a blip." In fact, it makes him wonder if 2017 was "the most boring year ever?"