For The Hesitant Billionaire: Black Friday Means 10% Off Your Next Yacht Booking

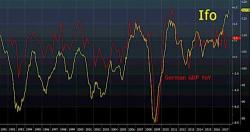

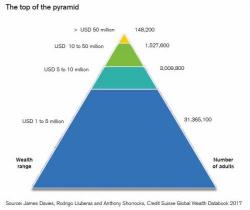

It's not exactly clear what message the following Black Friday offer from Royal Yacht Brokers is meant to send: that billionaires are becoming hesitant with their yacht charters, which would seem at odds with someone recently laundering $450 million using a rare Da Vinci painting, or that Credit Suisse's ultra high net worth clients who comprise the peak of this pyramid...