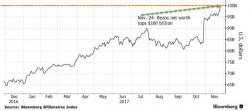

Jeff Bezos Becomes 2nd Man In History To Amass 12-Figure Fortune

$100,000,000,000....

That is the net worth of Amazon founder (and Washington Post owner) Jeff Bezos after Amazon's shares surged today on optimism over Black Friday.

As Bloomberg reports, the $100 billion milestone makes Bezos, 53, the first billionaire to build a 12-figure net worth since 1999, when Microsoft Corp. co-founder Bill Gates hit the mark.