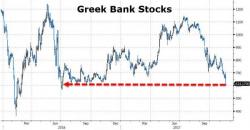

Kyle Bass Is Having A Bad Day - Greek Bank Stocks Crash To 16-Month Lows

Just over a month ago, Kyle Bass discussed why he was long effectively "long Greece."

Just over a month ago, Kyle Bass discussed why he was long effectively "long Greece."

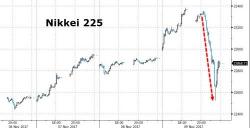

One week ago, on November 9 something snapped in the Nikkei, which in the span of just over an one hour (from 13:20 to 14:30) crashed more than 800 points (before closing almost unchanged) at the same time as it was revealed that foreigners had just bought a record amount of Japanese stocks the previous month.

Authored by Tom Luongo,

Bitcoin is back above $7500 as I write this after an enormous bout of volatility surrounding the failure to implement a protocol upgrade known as “Segwit 2x.”

Segwit 2x was designed to improve Bitcoin’s functioning in real world applications.

There was a classic pump and dump over the next 48 hours that saw Bitcoin spike to nearly $8000 and then collapse to $5500.

We all know the story behind Fisker, it was one of the world’s first plug-in hybrid electric vehicles in 2008, and even had a legal spat between Tesla, but shortly after in 2012 the company crashed and burned in bankruptcy. Last year, Henrik Fisker decided to relaunch his brand. He thought that one failure wasn’t enough—-just like Elon Musk’s SpaceX rockets.

As we noted shortly after the Crown Prince’s purge of potential rivals within Saudi Arabia’s sprawling ruling family, while the dozens of arrests were made under the pretext of an "anti-corruption crackdown", Mohammed bin Salman’s ulterior motive was something else entirely: Replenishing the Kingdom’s depleted foreign reserves, which have been hammered for the past three years by low oil prices, with some estimating that the current purge could potentially bring in up to $800 billion in proceeds.