Spot The Difference

US equity markets have rebounded aggressively off their opening plunge on the heels of a sudden magical bid...

Can you guess where from...

Now that Europe is closed - what happens next?

US equity markets have rebounded aggressively off their opening plunge on the heels of a sudden magical bid...

Can you guess where from...

Now that Europe is closed - what happens next?

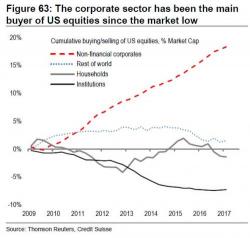

Ever since 2012 (see "How The Fed's Visible Hand Is Forcing Corporate Cash Mismanagement") we have warned that as a result of the Fed's flawed monetary policy and record low rates, corporations have been incentivized not to invest in growth and allocate funds to capital spending (the result has been an unprecedented decline in capex), but to engage in the quickest, and most effective - if only in the short run - shareholder friendly actions possible, namely stock buybacks.

Something changed...

Futures were weaker overnight but dumped at the cash open...

As the collapse in HY credit accelerated... worst day for HYG in 3 months

HYG is now negative year-to-date...

With spreads crashing back abopve 400bps...

USDJPY was unable to save stocks and VIX is now topping 14...

VIX is starting to catch up to credit...

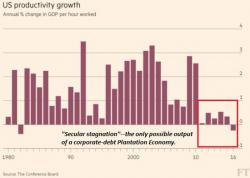

Authored by Charles Hugh Smith via OfTwoMinds blog,

Needless but highly profitable forced-upgrades are the bread and butter of the tech industry.

Hot CPI, disappointing retail sales, slumping surveys, and a drop in real wages... is it any wonder the yield curve just flushed another 3bps to a 75bps handle - the flattest 5s30s curve since Nov 2007.

This is the 13th daily flattening out of the last 15 days...

Everything changed after China intervened in it's FX market 'Shanghai Accord'-style...

There was some serious volume in Treasury futures as the data hit...