China's Credit Growth Is Freezing Up At The Worst Possible Time

Submitted by Gordon Johnson of Axiom Capital

CREDIT LEADS “ALL OTHER” ECONOMIC DATA IN CHINA

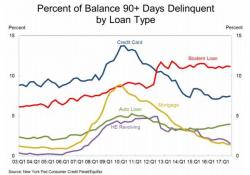

China until recently euphoric credit growth, is rapidly grinding to a halt. As we published last week, and a key underpinning of our negative outlook on commodity prices through the remainder of 4Q17 and into 2018, the moderation in China’s credit seen more recently appears to be gaining momentum. The evidence?