UBS Reveals The Stunning Reason Behind The 2017 Stock Market Rally

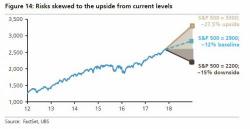

It's 2018 forecast time for the big banks. With Goldman unveiling its seven Top Trades for 2018 earlier, overnight it was also UBS' turn to reveal its price targets for the S&P in the coming year, and not surprisingly, the largest Swiss bank was extremely bullish, so much so in fact that its base case is roughly where Goldman expects the S&P to be some time in the 2020s (at least until David Kostin revises his price forecast shortly).