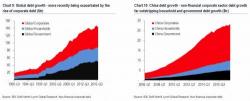

China Accounts For A Third Of Global Corporate Debt And GDP... And The ECB Is Getting Very Worried

There is a certain, and very tangible, irony in the central banks' response to the Global Financial Crisis, which was first and foremost the result of unprecedented amounts of debt: it was to unleash an even greater amount of debt, or as BofA's credit strategist Barnaby Martin says, "the irony in today's world is that central banks are maintaining loose monetary policies to generate inflation…in order to ease the pain of a debt "supercycle"…that itself was partly a result of too easy (and predictable) monetary policies in prior times."