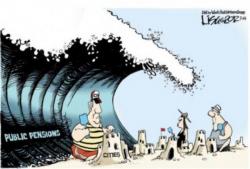

CalPERS Calls The Top: Largest Public Pension Fund Mulls Dumping $50 Billion Of Stocks

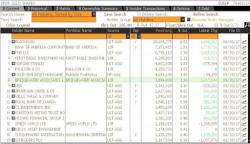

Is the largest public pension fund in the United States getting ready to dump about $50 billion worth of stocks? According to a new note from Bloomberg, CalPERS' board is meeting for a workshop today in Sacramento to discuss asset allocations for the upcoming year which could include a doubling of the fund's bond allocation from 19% to 44% which would be funded with a massive $50 billion sell down of equities.