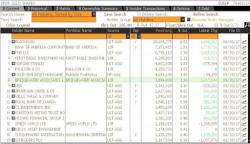

Ray Dalio Goes On Gold Buying Spree, Adds 575% To GLD Holdings, Becomes 8th Largest Holder

Until last quarter, the world's biggest hedge fund had, curiously, never held a position (according to our records) in any of the most liquid gold ETFs, whether the SPDR Gold Trust, the GLD, or the iShares Gold Trust, the IAU. That changed in the second quarter of 2017, when Bridgewater made its first tentative purchases in the gold ETF space, buying up 577,264 GLD shares, for $68.1 million, as well as 3.1 million IAU shares worth $36.8 million.