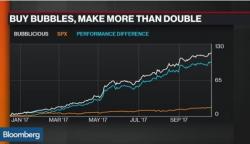

More New Normal - Buy Bloomberg's "Bubblicious" Index Of Bubbles - Make Out Like A Bandit

If only every year was this “easy”.

Unfortunately, the old adage of the trend being your friend becomes harder to adhere to as a guidepost as one asset market after another goes into bubble territory. As we discussed here, Alberto Gallo of Algebris Investments has ranked (see here) the top 14 bubbles worldwide, according to characteristics such as duration, appreciation, valuation and the degree of irrational behaviour.