Heat Death of the Economic Universe, Report 5 Nov 2017

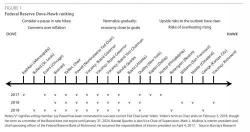

Steve Liesman's Saturday night report that NY Fed president, and former Goldman chief economist is retiring, was spot on and moments ago it was confirmed by the Federal Reserve Bank of New York which today announced that "William C. Dudley, president and chief executive officer, intends to retire from his position in mid-2018 to ensure that a successor is in place well before the end of his term. Mr. Dudley’s term ends in January of 2019 when he reaches the 10 year policy-limit in the role."

As was leaked by Bloomberg on Friday afternoon, this morning communications chipmaker Broadcom, which just last week announced it would move its headquarters from Singapore to the US (to make any future mega deals easier) said it offered to buy smartphone chip supplier Qualcomm Inc for $70 per share in a transaction valued at $130 billion, including $25 billion net debt, in what would be the biggest technology acquisition ever.

Following an early shaky start, which saw the Hang Seng tumble as much as 1.6% driven by weakness in financials and real estate names following the latest warning by PBOC governor Zhou about "sudden, complex, hidden, contagious, hazardous" risks In markets and a decline in local real estate prices, and pressure global risk, US equity futures have recouped all losses and are back to unchanged on monday morning, as President Trump continues on his first official trip to Asia.

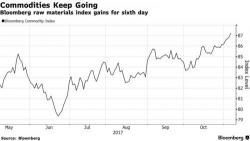

Overnight, following the recent Saudi turmoil, prices in the crude complex jumped to the highest levels in over two years, amid speculation that Saudi Arabia is more likely to back output curbs following this weekend’s crackdown by Crown Prince Mohammed bin Salman. "It creates some hope that the current policy by the Saudis will be continued after March,” said ABN Amro senior energy economist Hans van Cleef. "We’re still in the longer-term upswing, the uptrend is still intact", and indeed Dec.