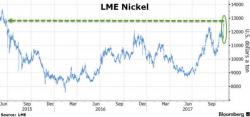

Nickel Price Surging As Hype Escalates During LME Week

It’s LME Week and there’s cause for celebration in metal markets. European mining stocks rose to a 4-year high as the nickel price surged more than 5% intraday to a two-year high and rose by the daily limit in Shanghai trading today. Metals used in electronic vehicles, like lithium, cobalt, copper and nickel, are hot right now and a focal point of discussion at the LME gatherings. As Metal Bulletin noted, the 2017 event has seen record attendance.