Facebook Beats Big But Shares Stumble On CEO Comments

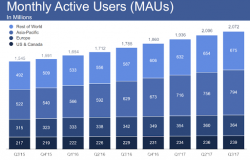

Amid Capitol Hill hearings and rising concerns over regulation, Facebook crushed expectations in Q3 - beating top- and bottom-line dramatically and better-than-expected user growth - sending the stock price higher after-hours to new record highs.