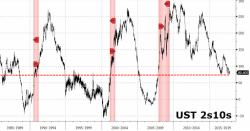

Last weekend, as Deutsche Bank's derivatives strategist Aleksandar Kocic was looking at the spread between the short and long end of the curve, and while contemplating the lack of market volatility, he concluded that "given where long rates are, Fed appears as overly hawkish – it has only two more hikes to go and, for volatility and risk premia to reprice higher, the gap has to widen. As is appears unlikely that the Fed will be cutting rates any time soon, the gap could widen only if the Long rates sell off."