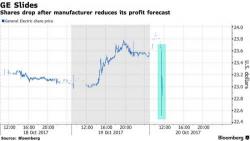

Junk Bond Managers Are Now Buying Equities

Stocks are so hot that junk bond managers want in to equity markets. Bloomberg’s Lisa Abramowicz explained the conditioning that’s led to this – simply that the performance rankings of corporate debt funds shows that those which are taking the most risk have, not surprisingly, booked the best performance in 2017. While this involved purchasing lower-rated credit instruments, in some cases, it has meant buying more equities.