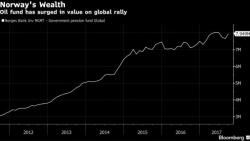

Norway's $1 Trillion Wealth Fund Gains 3.2% In Q3 As 70% Equity Allocation Pays Off

Last December we joked that the Norwegian sovereign wealth fund had responded to sinking returns and withdrawals required to fund budget deficits by allocating another $130 billion in assets to what appeared to be an already massively overpriced equity bubble in return for an extra 40bps of "expected average annual real returns" (see: Norway Buying $130 Billion In Global Equities As Sovereign Wealth Fund Continues To Bleed Cash). The extra equity purchases pushed the fund's total equity allocation to a staggering 70% of their $860 billion in assets under management.