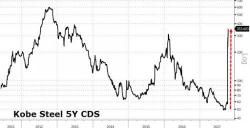

Bank Of Japan Is Buying Bonds From Scandal-Hit Kobe Steel

Last week, the simmering scandal involving Japan's third largest steel producer exploded, when following reports that Kobe Steel had falsified data about the quality of its steel, aluminum, copper, iron powder and other products it sold to customers across virtually every single industry, Japan's Nikkei also reported that some Kobe Steel plants in Japan had been falsifying product quality data for decades, well beyond the roughly 10-year time frame given by the lying steelmaker.